|

22A013 Tax Dodgers by Jim Davies, 3/29/2022

In the welter of comments and counter-comments encountered on what is called "social media" I recently found this: "I loathe companies that don't pay taxes. They depend on using roads and It's quite a common sentiment, especially on the political Left. It's part of a generally anti-business hatred, irrational though that is, and I can only guess at its source: that it was absorbed over time from Marxist teachers in school and college - who teach, because they lack the ability to do. They see nothing wrong with taxes, but foam at the mouth at the idea of avoiding them, especially by people richer then themselves. Notice, this stands more rational morality completely on its head. But that's not all that's bizarre about the quote in blue above; for the writer is focusing his hatred on a class of people who do not even exist. He is being deflected; while he ought logically to denigrate government, his attention is directed (by government apologists, of course) to phantom villains. Here's how. A tax exists only because a law was written, and if a company (or person) knowingly breaks that law, he will be prosecuted. Very unjust, but very factual. Now, in a country with many thousands of corporations, there will be a few whose accountants make mistakes about tax, and even a few who declare the wrong amount due on purpose; then the Collector will discover the error and correct it. So there are no "companies that don't pay taxes" - or not for long. It's a non-existent group. The guy is loathing imaginary people.

What I think he may have had in mind is the set of firms (and people) that studies the laws and finds ways to legally avoid paying more than they must. So for example if you have some expertese and a customer in Bermuda hires you as a short-term consultant for a week, you can deduct the cost of the trip even if you spend most of it enjoying the Bermudian beaches. Or if you do international business, you can establish your head office in a low-tax jurisdiction while most of the revenue is earned in high-tax ones; total tax is much lower. Perfectly legal. Apple Corp gives a fine example by setting such an arrangement up in Ireland. These are "Multinationals", like the cartoon suggests. And that's the point: no law is being broken, so the angry young Marxist rages against firms for paying less tax than they might, yet all the while he voted for the government that wrote the laws that the company is studiously obeying. He is, in effect, loathing himself. That cannot be healthy. However, tax-loophole laws are not the end of the story; rather, its beginning. Wealthy individuals and large corporations actively steer the formation of those laws. The trick is to get enacted taxes - and regulations - that hurt everyone at as flat a rate as possible. Big firms can absorb the cost of compliance much more easily than small ones, and that's a big advantage to the former, because size is a serious impediment. Nimble, small, innovative competitors are serious threats to cumbersome, large organizations; so any law that hobbles them gives the bigger firms a relative advantage. How do they do the steering? - by helping their most cooperative legislators get re-elected. They don't buy $10,000-per-plate seats at fundraising dinners for nothing; they expect a return on those investments, and they get it. So the cartoonist wasn't completely wrong; what he did miss was the law-writers, from the party on the upper deck. Without them, the tax-avoidance ship would go nowhere (and, of course, would have no reason to sail anywhere.) That's what will apply, in the coming zero tax, zero government society; and one incidental result will be that those innovative, small rivals will no longer be hobbled. Progress will consequently accelerate. Bring it on!

|

|

||||||||||||||||||||||||||||||||||||||||||||||

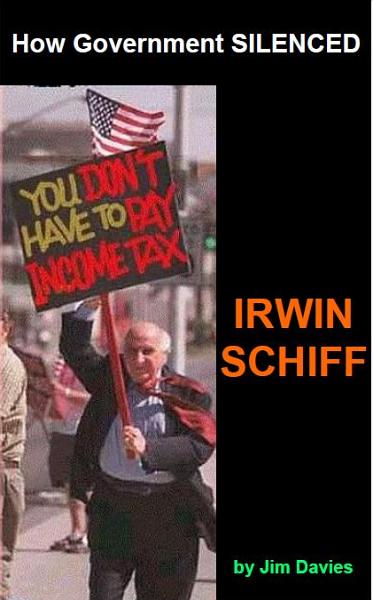

To forcibly deprive someone of property is theft, and to cheat the thief - to prevent the theft - is normally an action drawing praise or congratulation. But when the heist is described by the euphemism of "tax", the jackboot is on the other foot. The robber is regarded as the good guy, and his resistant victim as the one who prevents him pursuing his profession.

To forcibly deprive someone of property is theft, and to cheat the thief - to prevent the theft - is normally an action drawing praise or congratulation. But when the heist is described by the euphemism of "tax", the jackboot is on the other foot. The robber is regarded as the good guy, and his resistant victim as the one who prevents him pursuing his profession.