|

14A053 Bye-Bye, QE? by Jim Davies, 11/2/2014

With great fanfare, Janet Yellen announced as October ended that "Quantitative Easing", which is the Feds' euphemism for counterfeiting large sums of money, is over. It's been going on since 2008, so has had a 6-year run. The tale was that money was urgently needed to lubricate the economy after the collapse, and create jobs. An alleged $3.5 trillion has been created since then, and unemployment figures have been massaged to show an improvement - but often with part-time work, not full-time career jobs.

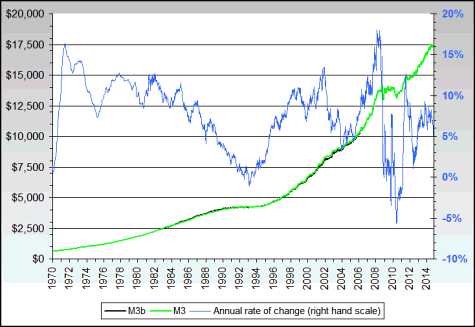

I chose M3, because it counts all the money, wherever it goes and however it's held, even though the Feds have stopped publishing it - so as conceal some of their counterfeiting. This chart comes from the very valuable estimates made by nowandfutures.com Notice that the money supply has risen from about $12.5 trillion in 2008 to $17.5 trillion today; that's a $5 trillion hike in six years, and so gives the lie at once to the claimed $3.5T. But more interesting yet is what happened in the previous six years, from 2002 to 2008; M3 rose from some $7.5 trillion to $12.5 trillion, also an increase of $5 trillion. So without QE the money supply rose $5T in six years, and with QE it rose $5T in six years. So much for the huge difference, for the emergency action! More: the $5T hike 2002-2008 was on a 2002 base of $7.5 trillion, and so represented a rise of 67%; whereas the $5T hike of 2008-2014 was on a base of $12.5 trillion and so amounted to a rise of only 40%. Even more: in 1996, M3 is shown at about $4.5T, on which base it rose by 2002 to that $7.5T, therefore by $3T or, again, 67%! Summarizing,

So the entire six-year charade has been a pretense. They have been inflating the currency like they have been doing for a very long time, but not quite as fast as when they were busy causing the Great Recession in the first place. The rate of its creation actually slowed down during the alleged "emergency" period of "QE." So there's good news and bad news; the former is that despite the fable fabricated by the Lords of the Money they have been moderating their monstrous currency debauchery, and the bad news is that since "QE" has now ended, they may revert to their earlier, even more profligate ways. A couple of other questions remain: (a) why hasn't this 6-year 40% rise, this annual 6% money-supply hike, produced an annual 6% inflation, and (b) what will happen to money in the coming zero government society? To (a), I'm sorry but I don't know. Clearly, the newly fabricated "money" hasn't been affecting the "basket of goods" the government uses to calculate annual inflation rates, but it does seem to have been reaching the stock market, which has been rising fast for no good reason - much as, prior to 2008, the bogus money found its way into home mortgages for people unable to repay them, and hence to the bubble which burst. Perhaps most of the new M3 is now being squirreled away by banks rather than being loaned out in the usual manner of fractional reserve operations. To (b) the answer is very clear: money will be the choice of the market, not that of the government (there being none) and will be made on the rational basis that the medium is hard to counterfeit, stable in value, and convenient to handle. Gold, silver and BitCoin are obvious candidates, when speculation on the latter has cooled off. Each can be purchased now, in timely preparation for that happy day. The result will probably be a modest deflation, because with a stable or slightly increasing money supply (eg miners dig up more gold) productive efficiency will increase at a greater rate and so pull prices down. This is exactly what did happen, during the 19th Century - the most prosperous in human history - even though money was managed, not free, and even though the managers were so ignorant and stupid as to set a double standard: silver and gold, in a fixed ratio. When no such manager remains in existence, the enriching effects of falling prices will take that record of prosperity and greatly exceed it. |

So I thought to take a look, and feel sure you too will want to know whether La Yellen is telling anything true.

So I thought to take a look, and feel sure you too will want to know whether La Yellen is telling anything true.